We’ve been focused lately on the struggles of systematic trend-following CTAs. They’ve had similar stretches in the past, but because the strategy makes up the majority of the managed futures world (and this down year is the 3rd in the past 4), this year’s disappointing performance has been a drag on the industry as a whole.

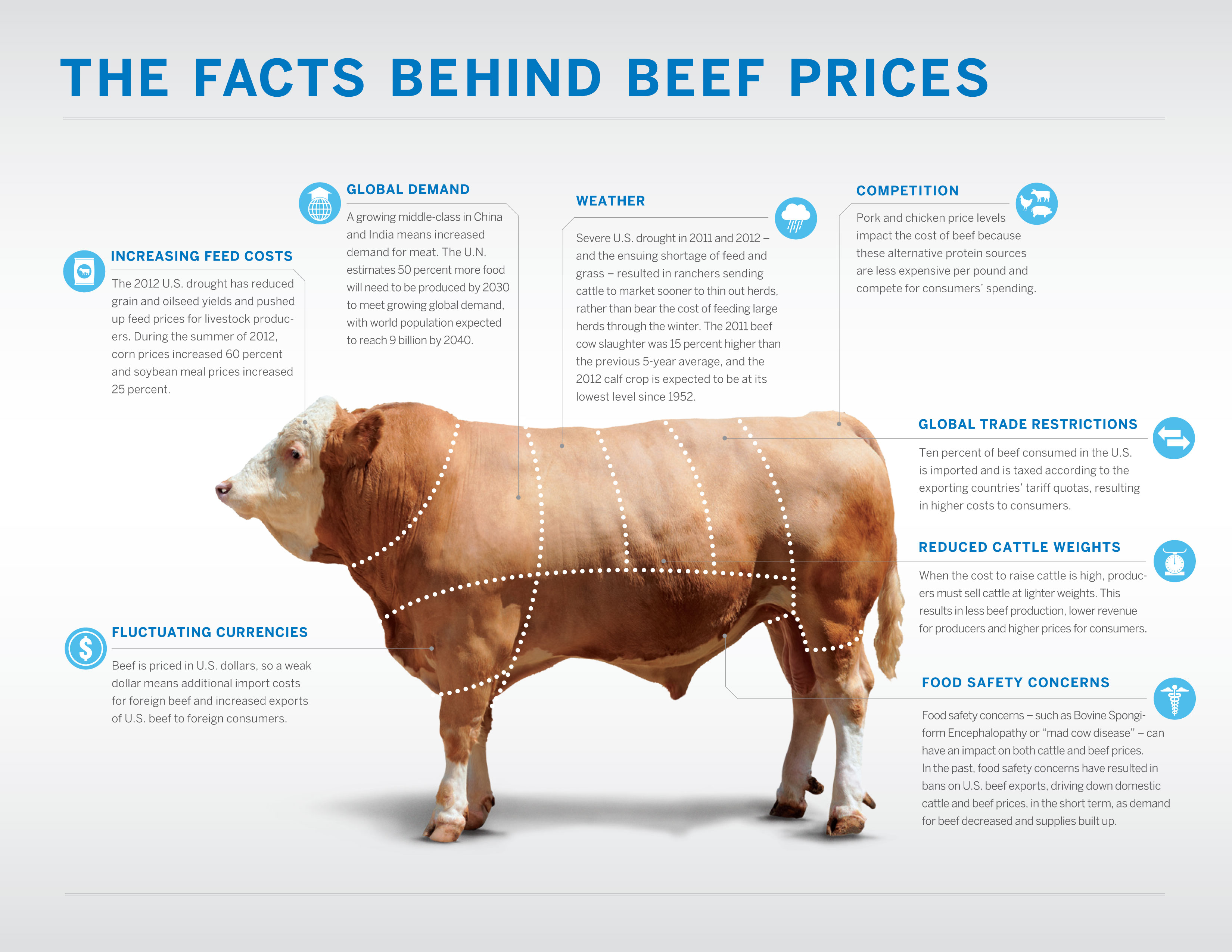

But, there is one bright spot: Ag traders (even though they have come down from their highs in many cases). Due in part to the big market moves driven by this summer’s drought, the Barclay Agricultural Traders Index is up 6.82% so far this year, compared to the broad CTA index down -1.56% (Disclaimer: past performance is not necessarily indicative of future results). And it’s not just us at Attain seeing the over-performance of Ag traders this year – the CME has released some nice infographics on the Ag space and what drives prices in these markets, such as cattle and corn.

And this highlights one of the big differences between Ag traders and the majority of the managed futures world: nearly all ag traders are discretionary/fundamental traders. Most have grown up in the industry, either working on farms or as a buyer for large Ag companies, and they use this expertise (and network of contacts) to get a “feel” for the Ag markets. They will look at crop reports, cattle reports, and import/export numbers to try and determine where the futures markets should be in relation to the cash market.

This isn’t to say Ag trading is purely discretionary: many still use technical indicators to determine buying and selling points, position sizes, as well as whether to execute via outright futures, spreads, or options once they determine which trades they want to put on. But this year has definitely shown that, when conditions are right, Ag traders can be an excellent diversification play.

PS: The CME’s graphic made us think of the old “cuts of meat” pictures you see hanging in a few Chicago steakhouses.